Articles

Earn 6percent money back for the find You.S. online streaming memberships. Cash return is gotten since the Award Cash which may be redeemed because the an announcement borrowing. Even better, a number of the best travelling cards are presently offering listing-highest greeting also provides.

- Your own recommendations must invest at the very least $100 with their the fresh account within two months out of subscription.

- One safe deposit field dismiss for each and every eligible account is actually welcome.

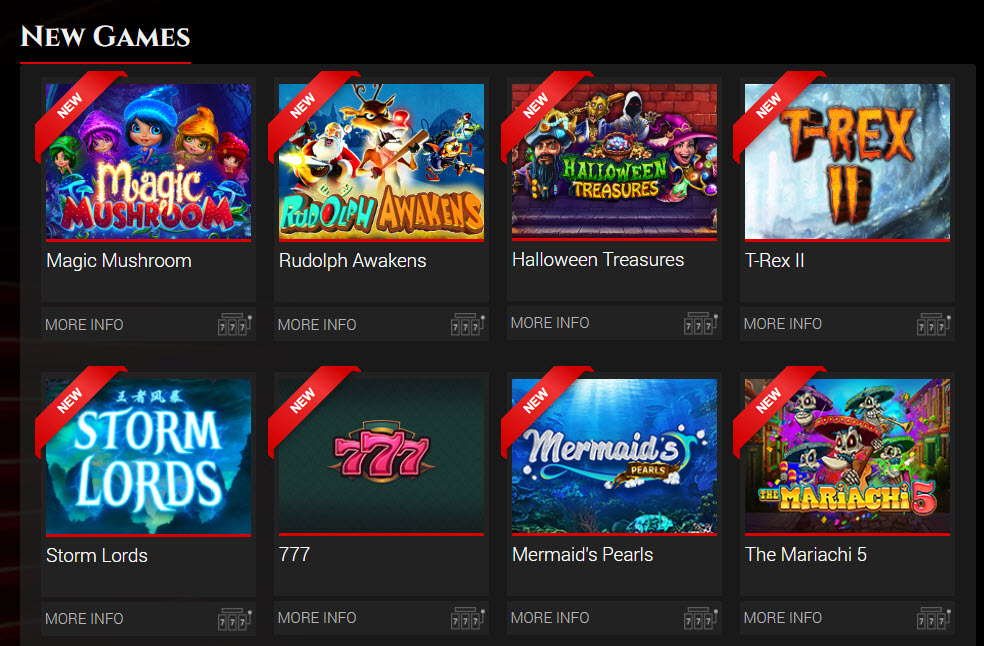

- When you’re provided a free No deposit Added bonus, it will basically enter the type of Free Cash Incentives or Free Spin Incentives.

- Very digital debits and you will credits on the business account count because the being qualified deals.

- Figuratively speaking is generally omitted from your DTI ratio if your fund is actually deferred to own one year.

But not, when the a cards offers terrific worth thru its ongoing perks and you may perks, it will secure a premier get and you can someplace inside our checklist even if they offers a leading annual percentage. At all, the best rewards cost and most worthwhile perks are usually found for the cards with annual costs. We explore individual paying research from the Bureau of Work Analytics discover a professional 3rd-group way of measuring somebody’s using models.

Tips Contrast Travel Playing cards

10,100000 MQMs for the condition once you spend $twenty-five,one hundred thousand to your cards within the a twelve months, as well as an extra ten,one hundred thousand MQMs once you purchase $50,one hundred thousand in the a twelve months. Cost-free use of American Share Centurion Lounges whenever traveling Delta with a solution purchased to your cards (around two traffic may also enter to possess a fee of $50 for every). 15,100 MQMs to the reputation after you invest $30,100000, $sixty,one hundred thousand, $90,one hundred thousand and $120,100000 to the card inside a season. This can be a robust welcome incentive for the Delta SkyMiles Precious metal Amex. Even though it’s beneath the best we have seen about this card, it’s still an invaluable offer worthwhile considering.

BMO’s Prominent Membership try a checking account for consumers seeking expand their balances. Prominent membership come with increasingly big benefits since you increase your combined harmony, to your better benefits set aside to possess users who keep $250,100 or higher in the places. The new Biggest checking account charges a keen avoidable $25 month-to-month account maintenance percentage. BMO Harris Financial from time to time also provides bank bonuses for new customers whom unlock a bank account and you will see campaign conditions. Financial bonuses is a single-time cheer offered to desire new customers. Karen Bennett try a customers banking reporter at the Bankrate.

The fresh 6 Finest Business Bank account Incentives And you may Campaigns

Most bank now offers usually certainly condition when and the ways to assume your hard earned money incentive, thus once again, read the fine print (i in addition to phone call that it away clearly in any render we publish on the BankBonus.com). The bonus payment is likewise given out various other forms, such as a visa Current Card or perks issues that you may use and make on line sales. Most of the time, it’s in the form of a funds added bonus that the lender sets directly into your membership. Because of this either you need manage an average each day balance, the typical monthly balance, a selected combined balance, otherwise at least harmony as needed from the financial.

Basic National Bank Out of Pennsylvania

As an example, M&T Financial might require a promotional code to be used at the enough time of account starting to help you be eligible for a plus. Concurrently, Nations Financial requires a coupon code and you can SoFi Money means no code after all. That is not fundamentally a detrimental issue, but it can make it difficult to monitor in which you are in the process of getting per extra. Along with, I were left with a couple of overdraft charge as the I wasn’t spending adequate desire and you can affect produced transmits in the wrong profile. Some banking institutions and waive charge if you fulfill an aggregate harmony minimum across all your account for the establishment. When you yourself have a variety of economic means you to definitely bank is see, believe starting numerous accounts to manage a lot more of your finances less than you to definitely rooftop—and save money on fees along the way.

According to your role, debt needcould getting impacted considering their marital reputation. Keep reading more resources for Refer-a-Friend as well as how you can earn incentive points. Jennifer Calonia is a la-centered writer and you may publisher who has been to your individual money defeat for more than ten years. The woman works could have been searched on the national publications such as Yahoo Money, MSN Money, Time Money, HuffPost, and much more.

No deposit In the long run

You’ll automatically earn Petro-Items once you purchase qualifying purchases along with your connected RBC Credit during the Petro-Canada cities and also you don’t need to swipe their Petro-Things credit before you can pay. You could get your own Petro-Issues in the Petro-Canada using your linked RBC Credit. Each time you make use of linked RBC Credit to purchase one levels of gas, or diesel, at the an excellent Petro-Canada location, you will lay aside three dollars ($0.03) for each litre during the order. 4) Complete 10 inbound otherwise outbound qualifying deals within this 60 days away from account opening.

Finest Brokerage Membership Campaigns

Extended warranty, Pick Protection, and you may Luggage Insurance policy Underwritten by the AMEX Assurance Team. Vehicle Leasing Losses and Damage Insurance Underwritten by AMEX Assurance Organization. Automobile Local rental Loss or Destroy Exposure is offered due to American Display Traveling Relevant Characteristics Business, Inc. Secure 5x points to the routes and 10x complete things for the lodging and auto leases after you pick travelling because of Chase Ultimate Benefits® just after the first $three hundred is allocated to travel purchases per year. Earn 3x points for the almost every other take a trip and you can eating and 1x point for each $step one allocated to all other sales.