This includes expenses like materials, labor, equipment and subcontractors accrued expenses vs provisions: what’s the difference directly used to do a project. Keeping track of COGS is important because it allows you to accurately calculate the profit margin on each project and make adjustments to pricing as needed. Put some thought into carefully structuring and organizing your chart of accounts. This ensures that your financial transactions are recorded accurately and consistently. Wherever you are, whatever the time of day or night, you will always have the most recent view of your accounts.

This helps ensure that all accounts are accurate and up-to-date, which enables more efficient and accurate business decisions. Construction companies often have a large inventory of materials and equipment that need to be managed properly. This includes tracking inventory levels, monitoring equipment usage, and ensuring that all equipment is properly maintained. Having a chart of accounts that includes specific accounts for inventory and equipment management can help streamline this process.

With a large workforce and multiple projects, managing payroll can become time-consuming and stressful. Chart of accounts helps to stay on top of payroll, reducing time to pay your laborers. A well-organized chart of accounts standardizes the accounting process and provides the structure for financial statements. If recurring transactions go to one account this month and another account next month, there’s no consistency and no one can have an accurate picture of how much is being spent.

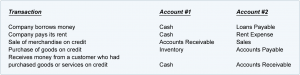

When done well, your chart of accounts ensures your financial statements accurately reflect the health of your company and helps you analyze your data to make informed decisions for your business. The chart of accounts, for a construction company, helps organize financial transactions in order to build financial statements. Financial statements summarize the amounts of transactions over a given period of time. Think of it like a blueprint that outlines the way your financial building is being constructed.

It’s important to keep in mind that once you establish a structure for your chart of accounts, it should remain consistent and shouldn’t change very often. You can add accounts as needed throughout the year, but you and your accountant should hold off on any major changes until the start of a new fiscal year. If you feel the need to revitalize your chart of accounts, always consult with your accountant first. As Warren Buffet said, “Accounting is the language of business.” From this language, your financial statements tell a story about your business. Equity represents the residual value of your company’s assets after all liabilities have been paid off. It’s the owner’s stake in the business and reflects the amount of money that would be left over if the company were to sell all of its assets and pay off all of its debts.

- A CoA is essentially a list of all the accounts under which financial transactions of a business are recorded.

- However, equity isn’t a surefire way to determine your specific value or ownership in a company.

- Cost of Goods Sold makes up a large part of construction contractors’ expenses.

- Conversely, under-segmentation can lead to a paucity of details, complicating the process of cost tracking and analysis.

Job Costing Integration: Aligning COA with Job Costing Reports

Customizing your COA to align with your business needs ensures better financial management and compliance with industry standards. Conversely, under-segmentation can lead to a paucity of details, complicating the process of cost personal accountant tracking and analysis. Make sure the Chart of Accounts is adequately segmented to gather the necessary data for precise reporting and informed decision-making. For instance, consolidating indirect costs into one account could make it hard to pinpoint areas for potential cost reductions.

These profits are retained in the business and can be used for future investments or to pay off debt. Make sure that each description provides enough information so that a new person on a job could dive in and easily make themselves familiar with your system. It’s important to stay on top of your liabilities to ensure that your company can meet its short-term obligations and have sufficient working capital or access to funds. In general, all assets that are used to fund long-term or future needs are reflected in capital assets accounts. We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for amounts they have not paid us for, is this legal?

Tailoring the Chart of Accounts for Construction Industry Needs

For this reason, a chart of accounts is a foundational accounting tool for providing the accuracy and structure needed to understand every transaction in your business. By focusing on simplicity and consistency, your COA will remain functional and effective as your business grows. Implementing these best practices will enable you to maintain an organized and accurate financial system, making informed decisions that drive business success. Retained earnings are an important part of equity, as they represent the company’s ability to generate profits over time. It’s important to track retained earnings separately from owner’s equity, as this will allow you to see how much of the company’s equity is tied up in profits that have not yet been distributed.

What Is Underbilling? Construction Industry Accounting

These include loans that you have taken out to finance your construction projects, such as mortgages, equipment loans, and lines of credit. Liabilities are financial obligations that your company owes to others, and they can be short-term or long-term. This helps to reduce the chances of having repeat and unnecessary accounts in your COA. Keeping your COA lean also eliminates clutter in transaction posting and reporting. You need to find a balance between the number of accounts and the required amount of detail.

Select Revenue Recognition Methods

This article is the ultimate guide for construction lien waivers including essential information and… The best bet is to start with a fairly standard chart, add accounts you know you want to track that are specific for your company, and how to efficiently manage capex capital project management software then wait a couple of months and reevaluate. If there are expenses that aren’t getting categorized correctly, look at redefining or renaming accounts to make them clearer. You’ll also want to categorize these expenses by service, and by individual job so you can easily track how much money came in as well as how much you spent on expenses. Using an expense tracker and saving your receipts can help you keep track of all of your expenses and project profits on each job.